NEWTON COUNTY – Amid the fiscal year (FY) 25 budget process, Newton County is looking to provide additional support for its employees.

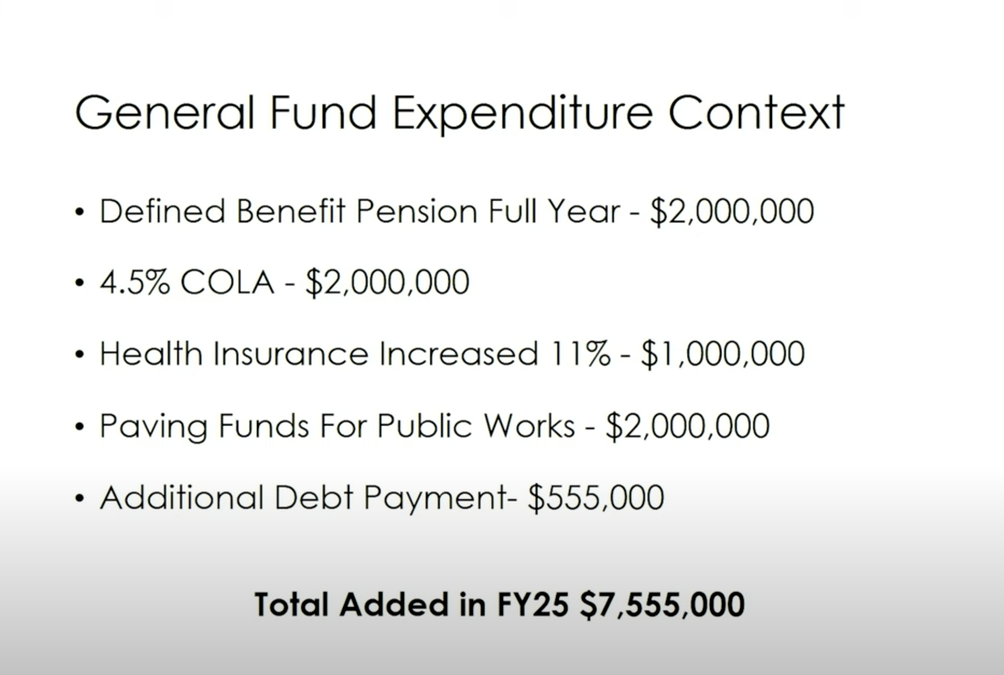

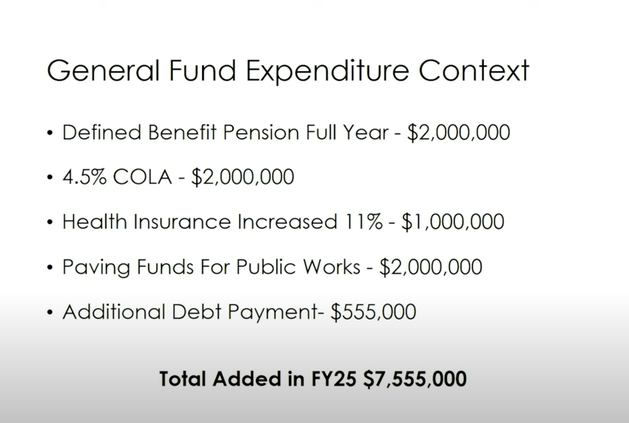

An over $7.5 million addition is currently being proposed in the general fund expenditure for FY25.

This includes a 4.5 percent cost of living adjustment (COLA) raise for all Newton County employees as well as $2 million in full-year defined benefit pension and a $1 million, 11 percent health insurance increase.

During the June 18 meeting, county manager Harold Cooper provided some added context on why the COLA and pension were proposed.

According to Cooper’s presentation, 148 employees fall under the $15.65-$17.99 pay rate, 92 employees fall under the $18-$19.99 pay rate and 247 employees fall in the $20-$23.93 pay rate. In terms of overall average salary, in Newton County that number is $43,250.

Compared to renting and ownership costs, an average rental price for all types of property is $1,992 per month and an average purchase price for a house is $349,900.

When explaining the defined benefit pension, Cooper said that FY24’s cost was reduced due to the pension being implemented in January. The cost of $2 million for FY25 is set to cover a full-year expense.

Cooper called the proposed COLA and pension an “employee retention mechanism,” calling it “simple” as to why it is needed.

“You want to retain outstanding talent,” Cooper said. “Without the workforce, we can’t have paved roads. We can’t have buildings inspected. We can’t have the tasks that are directed by you all, the taxpayers, in terms of making sure this place is a great place to live and serve.”

The county manager also cited inflation paired with fiscal responsibility as to why these exact numbers were decided.

“When you look at inflation, last year it floated around 4.1 percent for the majority of last year and then it flattened out at 3.4 percent,” Cooper said. “The increase to our budget is 3.1 percent. So again, being fiscally responsible is the key.”

Commissioners will vote on the final FY25 budget at a special called meeting on June 25.

Cooper also discussed millage rates and compared data from like-sized counties.

In his findings, Cooper cited Fayette and Lowndes counties as comparable to Newton County. Those counties have an average of $135,400,877 and an average millage rate of 9.604 mills.

The FY24 millage rate set by the Newton County Board of Commissioners (BOC) was 8.439 mills, a decrease from the FY23 rate of 9.454 mills.

Cooper shared with the public that tax hikes do not solely come from the BOC and that “other entities” determine an overall millage rate for the county. He specifically highlighted the Newton County Board of Education (BOE) in his presentation.

“If one entity increases their millage rate substantially, while the other rolls back their millage rate, the goal of providing taxpayers relief will not be accomplished,” Cooper said.

Last year, the BOE opted to decrease its millage rate to 16.000 mills, with fire maintaining its 0.892 millage rate. This brought the total millage rate to 25.331 mills.

Since 2018, the overall millage rate has seen a decrease from year-to-year. It is unknown if this will continue.

However, when asked by District 4 commissioner J.C. Henderson, if a full rollback was an option, Cooper said that “they are looking into it.”

The BOE will vote on its millage rate at the July 23 meeting. A date has not been set when the BOC will vote on its millage rate, but it is expected that the vote will take place at a meeting in July or August.