COVINGTON, Ga. — County officials said Newton property owners will see an almost 14% decrease in their tax rate to fund the 2022 county government budget.

Finance Director Brittany White told the Newton County Board of Commissioners Tuesday night that a property tax rate of 11.145 mills would be needed to help fund the budget — 14% below the 2021 rate of 12.916 mills.

The Newton County Board of Commissioners on Tuesday voted 3-1 with one abstention to approve the budget, which funds all of county government except the school system through June 30, 2022.

The board of commissioners still must approve the tax rate separately after a series of public hearings.

The proposed rate is also lower than the rollback rate of 11.5 mills. The state mandates that a rollback rate be calculated that is the tax rate that would produce the same amount of revenue as the previous year’s rate.

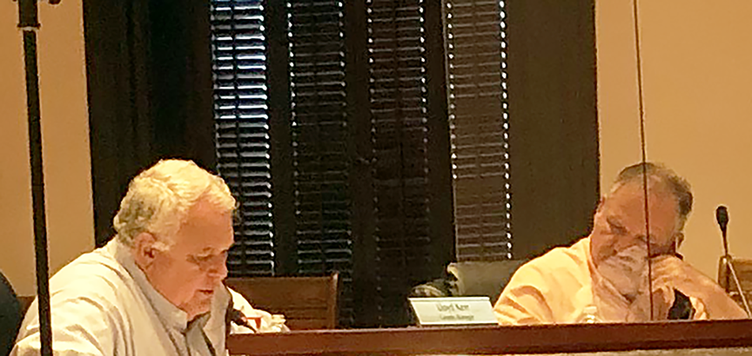

County Manager Lloyd Kerr said the tax rate was calculated based on the county’s tax digest — the total value of all taxable property — which increased by $424 million this year to $3.4 billion.

The 2022 budget totals $118.6 million and delays hiring of 32 new positions until January 2022 while giving a 4.5% pay increase to almost 700 county employees.

Spending in the budget’s largest part, the General Fund, totaled $77.6 million — a 1.4% increase from the 2021 budget.

The overall budget, however, increased spending 41% from 2021 mostly because expenditures for projects funded by the 2017 Special Purpose Local Option Sales Tax (SPLOST) were included, Kerr said.

Commissioners Stan Edwards, Demond Mason and Ronnie Cowan voted for the budget.

Commissioner Alana Sanders voted against it and said she opposed it because parts of the spending plan were not made transparent enough for taxpayers. Commissioner J.C. Henderson abstained from the vote and said he believed the tax rate needed to fund the budget should have been lower.

Board members approved the document after Kerr cut $500,000 from a first version of the 2022 budget that he gave to board members June 1.

Kerr on June 15 asked for a month's delay in approval of the budget after saying he wanted to make enough cuts to preserve across-the-board pay increases.

He said the county government needed the increases to remain competitive for new employees and retain existing employees in a tight labor market.

Meanwhile, commissioners generally had indicated they wanted to approve a property tax rate lower than the current 12.916 mills to offset an anticipated increase in tax bills because of higher assessments from rising land values.

He said changes he made to reduce the June 1 budget included use of more than $1 million in 2017 SPLOST revenues — rather than the General Fund — to pay the company ABM for what the county owes on a contract to provide energy savings in county government facilities.

Other changes included a decrease in spending by $379,000 by delaying the hiring of 30 new full-time and two new part-time employees until January 2022.

The budget still includes increases averaging 4.5% for the 694 employees on the county’s salary grade plan — including those in departments headed by constitutional officers.